Disclosure: This post may contain affiliate links, meaning I earn a small commission at no extra cost to you if you make a purchase through these links.

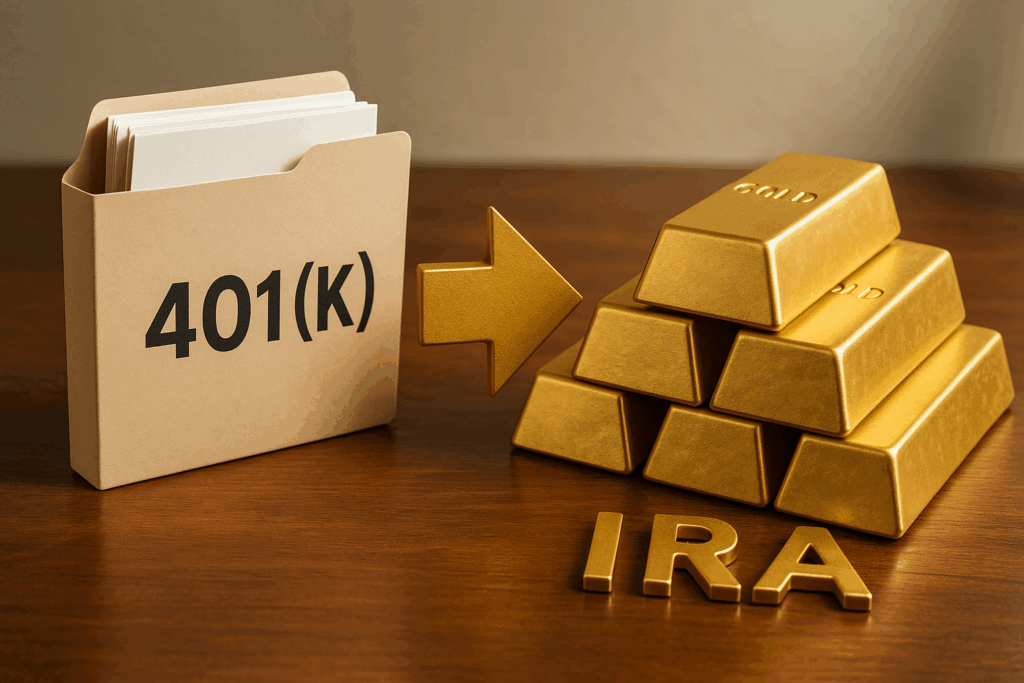

A 401k to gold IRA rollover is a great way to ensure your retirement funds grow tax-free.

By transferring your 401(k) balances to an IRA, you can avoid paying taxes on the money you move.

Top Picks of The Best Gold IRA Rollover Companies in 2026

Now that you know what a 401k to gold IRA rollover is, let’s take a look at some of the best companies that can help you do it.

#1 Augusta Precious Metals

Located in Beverly Hills, CA, Augusta Precious Metals is a gold IRA company that serves customers across the United States.

Founded in 2012, Augusta has over 10 years of experience in the precious metals industry. Augusta offers a wide range of services, including gold IRA rollovers, transfers, and purchases.

What sets Augusta apart from other gold IRA companies is its commitment to transparency. Augusta offers a flat-fee pricing structure with no hidden costs or fees.

Their customers know exactly how much they are paying and for what. For that reason, Augusta makes our list as the best gold IRA company for transparent pricing.

In addition to its commitment to transparency, Augusta also offers low costs and excellent customer service.

Their team is available to answer questions and help their customers make informed decisions about their investments.

For those reasons, we believe Augusta is the best gold IRA company for those looking for a reliable and transparent provider.

#2 Patriot Gold Group

Patriot Gold Group is a reputable gold IRA company that offers excellent customer service and competitive pricing.

The company has a long history of delivering superior consumer ratings and has an A+ rating from the Better Business Bureau.

Patriot Gold Group offers a wide variety of gold IRA products and services, making it a good choice for investors looking to diversify their portfolio with precious metals.

The company also provides a helpful online calculator that can estimate the current value of your gold IRA.

Overall, Patriot Gold Group is a great choice for investors looking for a reputable and affordable gold IRA company.

Patriot Gold Group has a long history of helping investors secure their financial future through gold IRAs.

The family-owned business has received high marks from consumer groups for delivering superior customer service while keeping its pricing competitive.

As a result, Patriot Gold Group is our choice as the best overall gold IRA company.

Patriot Gold has a great reputation with high marks from the key consumer rating agencies.

Patriot Gold has an AAA rating from the Business Consumer Alliance and a five-star rating from Consumer Affairs.

Patriot Gold is a dealer-direct firm, meaning that customers may buy gold, silver, platinum, or palladium bullion or coin at investor-direct pricing rather than paying the additional fee typically associated with such purchases.

On Patriot’s website, you will find no information regarding costs, minimums, or other specifics. You must contact them before signing up to find out this critical information.

Patriot Gold takes pleasure in its long track record of exceptional customer service.

Account managers pay close attention to their customers’ requirements from account set up, which you may do online or over the phone, with each transaction.

Account representatives aim to get inside their clients’ heads in order to make suggestions.

#3 Goldco

Goldco is a leader in the gold IRA industry, providing our clients with the knowledge and expertise they need to make informed decisions about their retirement savings.

We believe that everyone should have the opportunity to invest in gold, and our goal is to provide our clients with the tools they need to make sound investment choices.

We offer a wide range of services, including gold IRA rollovers and transfers, gold IRA self-directed accounts, and gold IRA 401(k) conversions.

We also offer a variety of educational resources, such as our Gold IRA Guide and our Gold Price Tracker, to help our clients stay informed about the market.

Whether you’re just starting to save for retirement or you’re looking for ways to diversify your portfolio, Goldco can help you reach your goals.

#4 American Bullion

American Bullion is a national leader in gold IRA rollovers and gold IRA transfers.

They have over a decade of experience in the precious metals industry, and they are one of the few companies that offer a full range of services for gold IRA owners.

Their goal is to provide their clients with the highest level of service and support, and they are committed to helping their clients diversify their portfolios and protect their wealth.

American Bullion is headquartered in Los Angeles, and they have an A+ rating with the Better Business Bureau.

They are a member of the National Association of Publicly Traded Companies, and they are accredited by the BBB.

American Bullion is a company that you can trust, and it will help you to make the most of your investment in precious metals.

Read: How to Buy SafeMoon on BitMart

#5 Regal Assets

Regal Assets is an accredited and insured precious metals IRA company that specializes in gold, silver, platinum, and palladium for physical delivery and storage within FDIC-insured vaults.

Unlike other companies, their philosophy is to educate first, then sell, rather than the hard sell approach.

This makes them unique in the industry and has resulted in an A+ rating with the Better Business Bureau.

They have also been featured in Forbes, Smart Money, The Economist, and Fox News and have had numerous 5-star customer reviews.

All of this has resulted in Regal Assets being one of the largest and most reputable precious metals IRA companies in the world.

So if you’re looking for a company that you can trust with your retirement savings, then Regal Assets is the obvious choice.

#6 Birch Gold Group

Birch Gold Group is a precious metals company that helps individuals and businesses to invest in gold and silver.

The Company was founded in 2003 with the mission of providing investors with a safe and easy way to purchase precious metals.

Since then, Birch Gold Group has helped thousands of people to protect their assets and preserve their wealth.

The Company offers a wide variety of products and services, including gold IRA rollovers, gold coins, and gold bullion bars.

In addition, Birch Gold Group provides educational resources to help customers make informed investment decisions.

Whether you’re looking to protect your retirement savings from inflation or diversify your portfolio, Birch Gold Group can help you reach your financial goals.

#7 Noble Gold Investments

Noble Gold Investments is a precious metals IRA company that was founded in 2010.

The company is headquartered in Los Angeles, CA and provides services to clients throughout the United States.

Noble Gold Investments specializes in gold IRA rollovers and offers a wide variety of investment options, including gold, silver, platinum, and palladium.

The company has a team of experienced precious metals specialists who work with clients to find the best investment options for their portfolios.

In addition, Noble Gold Investments offers storage and shipping services to clients who wish to store their precious metals in a secure location.

For clients who are interested in investing in precious metals but are not sure where to start, Noble Gold Investments offers free consultations to help assess your needs and goal.

Fidelity Investments

Fidelity Investments is a full-service financial services firm that offers a wide range of investment options, including stocks, bonds, mutual funds, and ETFs.

The company also offers retirement planning services, estate planning services, and more.

In addition to its investment offerings, Fidelity Investments also provides research and analysis to help its clients make informed investment decisions.

The company has been in business for over 70 years and manages over $2 trillion in assets.

#8 Vanguard

Vanguard is an American investment management company that offers a wide variety of financial products and services to individuals, businesses, and institutions.

Founded in 1975, Vanguard is one of the largest asset managers in the world, with over $5 trillion in assets under management.

Vanguard is best known for its index funds, which offer investors a low-cost way to track major stock market indexes such as the S&P 500.

Vanguard also offers mutual funds, exchange-traded funds (ETFs), and retirement planning products and services.

In addition to its investment products, Vanguard also provides financial planning and advisory services to clients.

#9 Advantage Gold

Advantage Gold is a young company that has made its mark as the best gold IRA company for first-time buyers.

Founded in 2014, Advantage Gold has strived to build a top-notch reputation by providing superior customer service.

The company has garnered top ratings from the BCA (AAA) with no complaints filed over the last three years.

Advantage Gold has a low minimum investment requirement and provides comprehensive educational materials to help customers make informed decisions about investing in gold.

The company also offers hands-on customer support to help investors through every step of the process.

By offering such an extensive suite of services, Advantage Gold has established itself as a leader in the gold IRA industry.

#10 GoldStar Trust

GoldStar Trust is a self-directed IRA custodian, trustee and escrow/paying agent that has been providing specialized services since 1994.

Our comprehensive services and commitment to customer service have made us the leader in the industry.

We are dedicated to helping our clients reach their retirement goals by providing them with the tools and resources they need to be successful.

We work closely with our clients to ensure that their self-directed IRA is compliant with all applicable laws and regulations.

We also offer a wide range of investment options, including traditional assets such as stocks and bonds, as well as alternative investments such as real estate and private equity.

Our focus on customer service and our commitment to providing the highest quality services make GoldStar Trust the obvious choice for self-directed IRA investors.

#11 First Eagle Gold LLC

First Eagle Gold LLC is a global investment management firm. Founded in Europe in 1864 and headquartered in New York since 1937.

First Eagle has a long history of managing assets for institutions and individual investors around the world.

Today, First Eagle manages billions in assets across a range of strategies, including equity, fixed income, private equity, and alternative investments.

Our commitment to maximizing client outcomes is reflected in our investment-centric culture, which places a premium on disciplined research and rigorous risk management.

Within our Gold strategy, we seek to provide exposure to the investment characteristics of gold and, to a limited extent, other precious metals.

Our disciplined approach combines fundamental and technical analysis with active portfolio management to identify opportunities in the gold market. The strategy is offered in Class A (SGGDX) shares.

#12 Dillon Gage Metals

Dillon Gage Metals is one of the largest precious metals trading firms in the world, with over 40 years of experience serving dealers, financial institutions, banks, brokerages, and high-wealth private clients.

Dillon Gage is authorized to purchase directly from sovereign mints such as the United States Mint and the Royal Canadian Mint, offering access to a wide range of products at competitive prices.

The company has a strong commitment to customer service, with a team of experienced professionals who are dedicated to providing the best possible experience.

Dillon Gage also has a presence in Singapore, making it easier for international clients to do business with the firm.

With its deep knowledge and global reach, Dillon Gage Metals is a trusted partner for trading precious metals.

#13 Perth Mint

Founded in 1899, the Perth Mint is Australia’s largest fully integrated, innovative precious metals enterprise.

They provide premium gold, silver and platinum products and services to markets throughout the world.

The products are backed by the Western Australian Government, making us the world’s only government-owned and guaranteed precious metals enterprise.

With over 120 years of experience servicing and promoting the gold industry, they have built a reputation for excellence.

The state-of-the-art facilities enable us to produce high quality precious metals products that meet the strictest international standards.

They are also leaders in minting innovation, with a range of unique products that are highly sought after by collectors and investors around the globe.

As a result of our commitment to quality and service, they have earned the trust of our clients and partners across the globe.

They look forward to continuing to build on our reputation as a world-class precious metals enterprise.we can do for you.

#14 Rosland Capital

Rosland Capital is a precious metals asset management firm based in Los Angeles, California.

The company was founded in 2008 and is best known for its television commercials starring actor William Devane.

Rosland Capital sells gold and other precious metals in physical form, and offers a variety of investment products and services to its clients.

In addition to its retail business, Rosland Capital also provides institutional investors with access to the precious metals markets through its wholesale division.

The company has a strong commitment to customer service and has been accredited by the Better Business Bureau since 2009.

Rosland Capital is a trusted source for precious metals investments, and its experience and expertise make it a valuable partner for those looking to add gold and other precious metals to their portfolios.

This guide will show you how to do it quickly and easily, with minimal risk.

Read: Best gold IRA custodians

What Exactly is a 401k to Gold IRA Rollover?

A 401k to gold IRA rollover is simply the process of transferring your retirement savings from a 401(k) plan into a gold Individual Retirement Account (IRA).

This can be done by either rolling over your existing 401(k) into a gold IRA, or by opening a new gold IRA and transferring your 401(k) funds into it.

Either way, the money in your 401(k) will become tax-free when it is moved into an IRA.

Unlike paper assets like stocks and bonds, gold is a physical asset that is not subject to the same volatility.

Over the long term, gold has outperformed other asset classes, making it an attractive choice for those looking to protect their retirement savings.

The Comprehensive Guide on How to Perform a 401k to Gold IRA Rollover

Below, we’ll walk you through the process of how to do a 401k to gold IRA rollover, step by step.

We’ll also give you the best 11+ companies that can help you with your rollover, so that you can choose the one that’s right for you.

Also Read: Best Gold IRA Companies

Top 7 Reasons to Rollover Your 401k Into a Gold IRA

There are many reasons to rollover your 401k into a gold IRA. Here are some of the most popular:

1. You can protect your retirement savings from market volatility

Most people understand the importance of saving for retirement, but fewer people know how to protect those savings from market volatility.

One way to safeguard your nest egg is to rollover your 401k into a Gold IRA. Gold is a physical asset that has historically maintained its value, even during times of economic upheaval.

A Gold IRA also offers other benefits, such as tax-deferred growth and the ability to make penalty-free withdrawals for certain expenses.

This makes it an ideal retirement account for those who are looking for stability and peace of mind.

So if you’re looking for ways to protect your hard-earned retirement savings, rolling over your 401k into a Gold IRA is worth considering.

2. Gold is a proven hedge against inflation

When it comes to retirement planning, there are a lot of factors to consider. One important question is how to protect your savings from inflation.

After all, if the cost of living rises but your retirement income stays the same, your buying power will decrease over time.

This is where gold comes in. Gold has been a proven hedge against inflation, meaning that it tends to go up in value when prices are rising.

As a result, rolling over your 401k into a gold IRA can be a smart move for anyone who is concerned about protecting their nest egg from inflation.

In addition to being a hedge against inflation, gold is also a safe haven asset. This means that it tends to hold its value during times of economic uncertainty.

So, if you’re worried about stock market volatility in retirement, investing in gold can help you sleep better at night.

3. Gold has outperformed the stock market in recent years

Gold has outperformed the stock market in recent years, making it an attractive investment for anyone looking to preserve their retirement savings.

Rolling over your 401k into a gold IRA is a smart way to diversify your portfolio and protect your hard-earned savings from market volatility.

Unlike stocks and other paper assets, gold is a tangible asset with real intrinsic value.

Gold has been used as a store of wealth for centuries, and its value is not subject to the whims of the stock market.

With a gold IRA, you can rest assured that your savings are protected against inflation and economic instability.

So if you’re looking for a safe and secure way to invest for retirement, rolling over your 401k into a gold IRA is a smart choice.

4. Gold is a global currency and is not tied to any particular economy

Gold is often seen as a safe haven asset, and for good reason. Unlike fiat currencies, gold is not subject to inflationary pressures, and it is not directly tied to the performance of any particular economy.

As a result, gold can be an important part of a diversified portfolio, providing a valuable hedge against market volatility.

Rolling over your 401k into a gold IRA is one way to add exposure to this unique asset class.

With a gold IRA, you can invest in physical gold, which can be stored in a secure location, or you can invest in gold-backed exchange-traded funds (ETFs), which provide convenient and cost-effective exposure to the gold market.

Whichever route you choose, adding gold to your retirement portfolio can help to protect your hard-earned savings from market volatility.

5. Gold is a tangible asset that can be easily stored and accessed

Gold is a popular choice for 401k rollovers for a variety of reasons. Unlike paper assets, gold is a tangible asset that can be easily stored and accessed.

Gold is also one of the few assets that retains its value during periods of inflation or economic downturn.

In fact, gold often increases in value during times of economic turmoil, making it an ideal way to protect your retirement savings.

Additionally, gold offers a degree of portfolio diversification, as it tends to move independently of other assets such as stocks and bonds.

For these reasons, rolling over your 401k into a gold IRA can be a smart way to safeguard your retirement savings.

6. Gold IRA rollovers are tax-free and penalty-free

When it comes to retirement planning, there are a lot of different options to consider. One of the most popular choices is a 401k plan.

However, there are a few drawbacks to this type of plan that might make a gold IRA rollover a better choice for some people.

One of the biggest advantages of a gold IRA rollover is that it is tax-free and penalty-free.

This means that you will not have to pay any taxes on the money that you roll over into your account.

Additionally, there are no penalties for early withdrawal, which can be a big advantage if you need to access your funds before retirement.

Another reason to consider a gold IRA rollover is the potential for inflation protection.

With a traditional IRA, your money is invested in stocks and bonds, which are susceptible to fluctuations in the market.

However, gold tends to retain its value well during periods of inflation, which means that your retirement savings will be worth more in the long run.

Overall, there are a lot of good reasons to consider a gold IRA rollover.

If you are looking for an investment that offers tax-free and penalty-free growth potential, then a gold IRA might be the right choice for you.

7. You can add other precious metals to your IRA, such as silver and platinum

You may be considering rolling over your 401k into a gold IRA. There are several reasons to do this, and one of them is that you can add other precious metals to your IRA.

For example, you can add silver and platinum to your IRA. This diversifies your portfolio and provides additional protection against inflation.

Gold is a good investment, but it is not the only metal that can provide benefits.

By including other precious metals in your IRA, you can maximize the potential benefits of this retirement account.

Gold IRA Rollover Latest News, Data For Today in March 2026

How to Open a Gold IRA?

A gold IRA is a retirement account that allows you to invest in physical gold.

Unlike a traditional IRA, which is only allowed to invest in paper assets, a gold IRA gives you the flexibility to diversify your portfolio with a hard asset.

If you’re interested in opening a gold IRA, there are a few things you need to know.

Find a custodian

First, you’ll need to find a custodian that offers gold IRAs. Not all custodians offer this type of account, so it’s important to do your research.

Fund Account

Once you’ve found a custodian, you’ll need to open an account and fund it. You can fund your account with cash or by rolling over an existing retirement account.

Buy Gold

Once your account is funded, you can begin buying gold. You can purchase gold bullion, coins, or bars.

It’s important to remember that only certain types of gold are eligible for inclusion in a gold IRA.

For example, collectible coins are not typically allowed. Once you’ve purchased your gold, it will be stored in a secure location by your custodian.

Opening a gold IRA is a great way to protect your retirement savings from inflation and market volatility.

4 Steps to Completing a 401(k) to Gold IRA Rollover?

If you’re interested in rolling over your 401(k) into a gold IRA, there are a few steps you’ll need to follow.

Contact the company managing your 401(k)

First, you’ll need to contact the company managing your 401(k) account and let them know of your intention to rollover the funds.

Choose between a direct and indirect rollover

Then, you’ll need to choose between a direct and indirect rollover. With a direct rollover, the company will send a check with your funds directly to your gold IRA custodian.

With an indirect rollover, the company will send the check to you, and you’ll then have 60 days to deposit the funds into your gold IRA.

Satisfied any special requirements the company might have for rollovers

Finally, make sure you’ve satisfied any special requirements the company might have for rollovers.

For example, some companies might require that you be at least 59 1/2 years old or that you’ve held the account for a certain amount of time before performing a rollover.

Check or Transfer Initiated

Once you’ve completed all of these steps, the company will send a check with your retirement savings to either you or your gold IRA custodian, depending on which type of rollover you chose.

Should You Do a 401(k) to Gold IRA Rollover?

There are a few things to consider before you do a 401(k) to gold IRA rollover.

First, it’s important to understand that you will be responsible for any taxes and fees associated with the rollover.

Second, you will need to find a custodian who can hold your gold IRA. And finally, you will need to decide how you want to invest your gold IRA.

With that said, there are a few reasons why a rollover might be right for you. First, gold is a great way to diversify your retirement savings.

Unlike paper currency or stocks, the price of gold isn’t as susceptible to volatility. Second, gold is a hard asset that can’t be printed or created by central banks.

This makes it a good hedge against inflation. And finally, owning gold gives you the peace of mind that comes with having a physical asset that you can hold in your hand.

If you’re looking for an alternative to traditional retirement options, a 401(k) to gold IRA rollover might be right for you. Just be sure to do your research and understand the associated costs before you make the move.

The Bottom Line

There are several reasons why rolling over a 401k to a gold IRA is a good idea. For one, it can provide greater diversification for your retirement portfolio.

Gold can act as a hedge against inflation and economic uncertainty, which can help to preserve the purchasing power of your retirement savings.

Additionally, gold IRAs tend to have lower fees and expenses than traditional IRAs, which can further increase your savings.

Finally, having a gold IRA can provide peace of mind knowing that you have taken steps to protect your hard-earned retirement savings.

Frequently Asked Question About 401k to Gold IRA Rollovers

Can I do a 401k to gold IRA rollover if I am still employed?

A: Yes, you can do a 401k to gold IRA rollover even if you are still employed. However, there may be some restrictions placed on your account by your employer.

How much gold can I hold in my IRA?

A: There is no limit to how much gold you can hold in your IRA. However, there are annual contribution limits for IRAs as a whole.

What types of gold can I hold in my IRA?

A: You can hold bars, coins, and rounds in your IRA. However, there are certain purity requirements that must be met.

Will I have to pay taxes on my gold IRA?

A: No, you will not have to pay taxes on your gold IRA. However, you will be responsible for any taxes and fees associated with the rollover process.

Can I roll over my 401k to a gold IRA if I have other retirement accounts?

A: Yes, you can roll over your 401k to a gold IRA even if you have other retirement accounts. However, you will need to make sure that you satisfy any special requirements that your company might have for rollovers.

What happens if I don’t roll over my 401k to a gold IRA?

A: If you don’t roll over your 401k to a gold IRA, you will still have the same retirement savings. However, you will be subject to taxes and fees on those savings when you retire.

Can I do a partial rollover of my 401k to a gold IRA?

A: Yes, you can do a partial rollover of your 401k to a gold IRA. However, you will need to make sure that you satisfy any special requirements that your company might have for rollovers.

How long does it take to roll over a 401k to a gold IRA?

A: The rollover process can take anywhere from a few days to a few weeks. However, it is important to note that the timeline can vary depending on your custodian and the type of assets you are rolling over.

What should I do with my old 401k after I roll it over to a gold IRA?

A: Once you roll over your 401k to a gold IRA, you can close your old account. However, you may want to keep it open if you have a balance that is higher than the contribution limit for IRAs.

Do I need to liquidate my 401k to roll it over to a gold IRA?

A: No, you don’t need to liquidate your 401k to roll it over to a gold IRA. However, you will need to make sure that you have enough cash available to cover any taxes and fees associated with the rollover process.

What is the difference between a direct and indirect rollover?

A: A direct rollover is when your custodian transfers your assets directly to another custodian. An indirect rollover is when you withdraw the assets from your current custodian and then deposit them into a new account within 60 days.

Can I do a 401k to gold IRA rollover if I have a balance in my 401k?

A: Yes, you can do a 401k to gold IRA rollover even if you have a balance in your 401k. However, you will need to make sure that you have enough cash available to cover any taxes and fees associated with the rollover process.

What is a 401k?

A: A 401k is a retirement savings account that is sponsored by your employer. It allows you to save for retirement on a tax-deferred basis.

What is an IRA?

A: An IRA is an individual retirement account that allows you to save for retirement on a tax-deferred basis.

How do I know if a gold IRA is right for me?

A: A gold IRA may be right for you if you are looking for a way to diversify your retirement savings and minimize your exposure to risk.

What are some free online resources I can use to learn more about gold IRAs?

A: There are a number of free online resources that can be used to learn more about gold IRAs. The following are some of the most useful:

- The first stop for anyone interested in learning about gold IRAs should be the website of the US Mint. The US Mint is the government agency responsible for minting and distributing US currency, and they also have a lot of information on investing in gold.

- The website of the US Department of the Treasury provides a wealth of information on investing in gold IRA, including eligibility requirements and how to set up an account.

- The Internal Revenue Service also has a helpful website with information on gold IRAs, including tax implications and how to report gains or losses.

- The Kitco website provides live gold prices, as well as news and analysis on the gold market.

- The Gold Eagle website offers a comprehensive guide to investing in gold, including articles on choosing a reputable dealer and choosing the right type of gold for your IRA.